We indicated in our previous Market Update there has been a fractional decline in the rental market, which is mirroring the cooling sales market. This continues to be the case across the Hunter region and warrants a shift in expectations on what the immediate future holds for property investors.

Using our monthly leasing figures for the year so far, we have delved into the trends we are seeing across the Residential and Commercial portfolios, some of which, will likely carry forward into 2023.

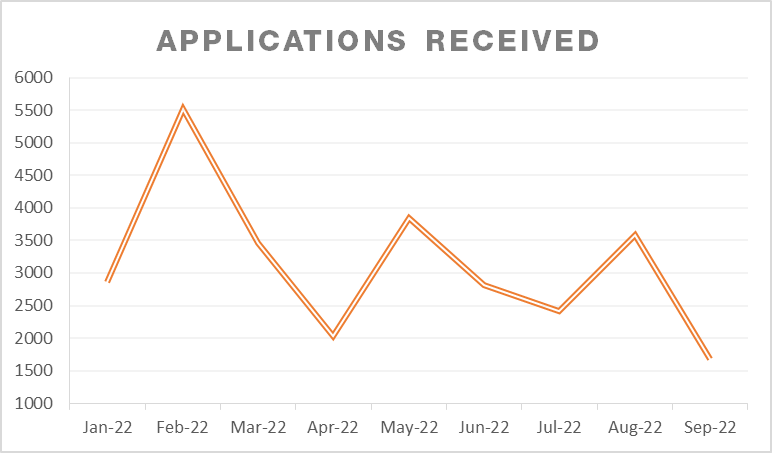

As you can see below, applications received have been incrementally trending down over the past months. While there isn’t a huge decline in inquiry level, our Leasing team has noted there is a smaller pool of quality tenants for selection.

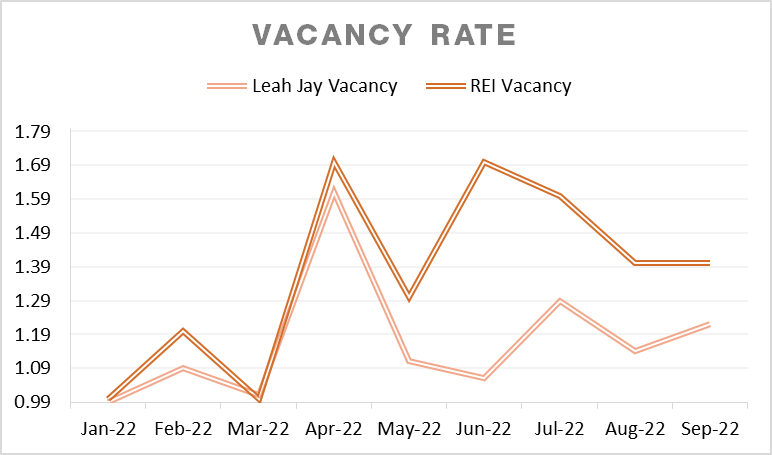

This is in spite of a continually low vacancy rate, which we had expected would rise slightly as more stock becomes available for prospective tenants. But as you can see below, the vacancy rate is staying under the 2% mark month-on-month, with Leah Jay’s staying below the regional average for the entirety of this year. This shows we are still waiting for a correction to the supply and demand issues the wider Hunter has been continually facing in housing post-COVID.

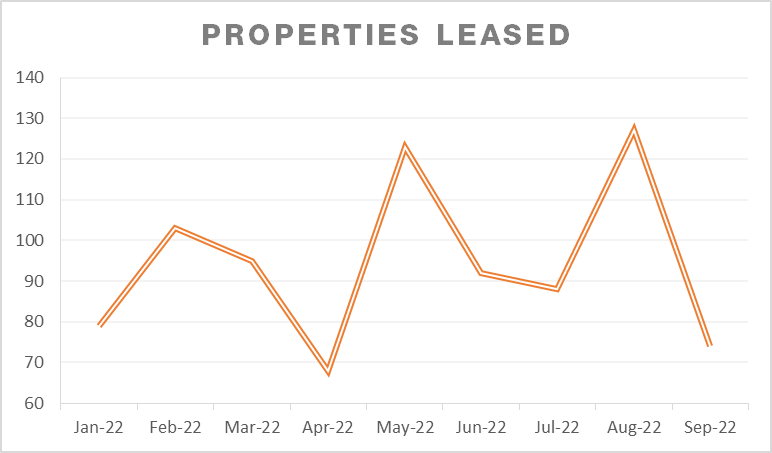

With such limited supply, this does mean our properties leased have remained consistently high month-on-month. Our Leasing team has also found our virtual leasing process remains popular with prospective tenants, despite the reintroduction of open houses, with many still opting to view the 360 virtual tours prior to applying.

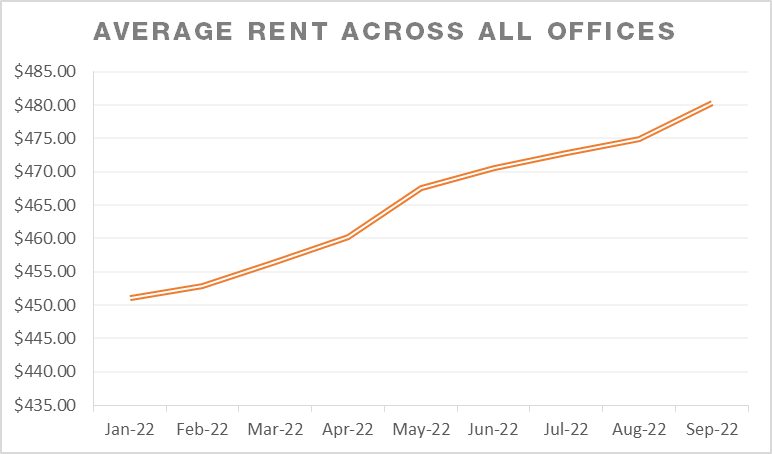

Finally, a phenomenal sales period and increased value of property in the region, means the average rent achieved has been steadily increasing across Leah Jay’s areas of service – Newcastle, Lake Macquarie, Maitland, and the Hunter.

However, it should be noted, achieving the maximum rental return from your investment requires more than just rent increases. This is why our property managers work closely with our Investment Services team to explore all avenues in portfolio optimisation such as renovations, developments, or releasing equity to purchase additional properties.

This approach means as an owner, you are able to future-proof your capital growth so if the market begins to slow, as the data is indicating it is, you can still achieve maximum return from your portfolio. This is something we encourage you to begin thinking about now as the property market continues to cool and interest rates rise. And if you would like to discuss your options further, please get in touch with your property manager or our Investment Services team, who can also offer a Property Health Check on your investment.

Key Takeaways

- The rental and sales markets are cooling, reflecting a decline in the Hunter region, indicating a shift in property investment expectations.

- Monthly leasing figures show a trend of decreasing applications, although inquiry levels remain substantial, pointing to a smaller pool of quality tenants.

- Despite expectations for a rise, the vacancy rate remains under 2%, signifying ongoing supply and demand issues in housing post-COVID.

- Virtual leasing processes are popular, complementing traditional open houses, and the average rent achieved has been steadily increasing.

- Property managers work with investment services to optimize portfolios through renovations, developments, or equity release for further property purchases, advising owners to prepare for a cooling market and interest rate rises.