A softening market is a great time to look at purchasing a property whether you’re a tenant looking to buy or an investor looking to add to your portfolio.

Contents

Should I consider buying in this softening market?

Investors

Leah Jay Investment Services are working with several investors at any one time to assist them as they look to purchase either for the first time or to add to their portfolio. Whilst some people are put off by high-interest rates, other seasoned investors are taking full advantage of the lull in the market to build their portfolio.

Pippa Rose, Lead Investment Services Manager at Leah Jay said; “Rents have seen good growth over the last 18 months which means rental yields have become more attractive. The talk about steadying interest rates also gives investors/purchasers some additional confidence that they will soon stabilise and possibly even lower later in the year.”

“Many of our owners have seen a 20%-30% growth in their properties locally, despite the 9% pullback over the last 12 months. They have a lot of equity in their properties and can use this equity, and the higher rental yield, to increase their borrowing capacity. Seasoned investors understand the importance of looking at a complete property lifecycle, and logically factor in higher interest rates as part of their calculations.”

Tenants, First-time buyers, and Rentvestors

We are noticing that first-time buyers are entering the market again, albeit a little more cautiously than previously. With recent changes to replace Stamp Duty for a Property Tax, and for those who have their deposit ready, enjoying more reasonable prices than last year and preparing for higher rate rises is encouraging them to enter the market.

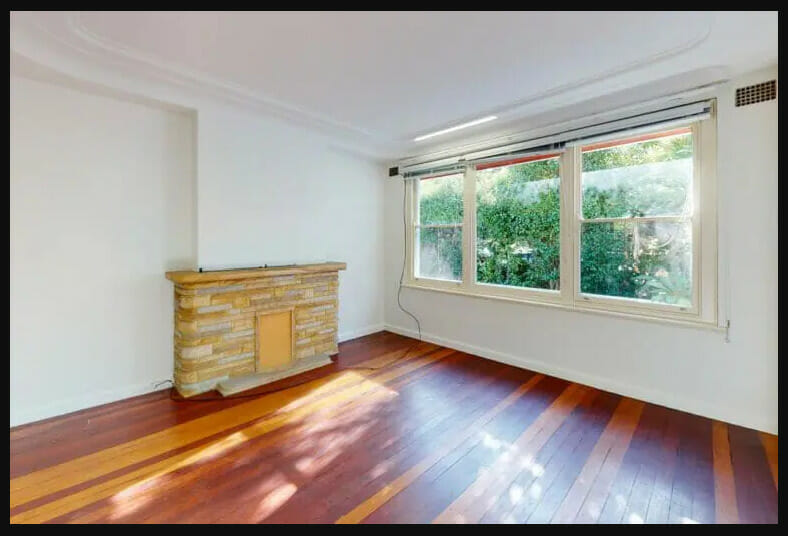

Pippa states, “We work with first-time buyers as they maximise the 6 months that they need to live in the property to increase their ROI for when they rent out that property. During this 6-month period, they prepare it as an investment property by undertaking renovations or minor improvements. This increases rental prices and facilitates leasing. Our investment services team guides new investors through the entire process. This includes ensuring they have the correct insurance in place, obtaining an updated valuation for future CGT considerations, and Tax Depreciation Schedules if applicable.”

The team recently worked with *Sarah who purchased a property last month. We advised her what to do and when to go about doing it to maximise her ROI. While living there for 6 months, she is in the process of repainting, adding ceiling fans and a deck. She’ll then move back into her parent’s home and rent it out. With Mum and Dad’s blessing, Sarah plans on continuing the repayment of her mortgage while adding the rent to her own payments. Her 5-year plan is then to move back in and extend the property. The property sits on a large block, so we suggested the future option of adding a Granny Flat as another investment property.”

Borrowing Capacity

Exploring your borrowing capacity or looking to refinance?

Christine McGregor from McGregor Finance Group commented, “We have seen mortgage repayments significantly increase for many homeowners and investors over the past 9 months. This has placed mortgage holders under extreme pressure, and in some cases has seen lenders’ interest rates more than double. With these increased costs, borrowers are now seeking to refinance opportunities, but when trying to refinance, borrowers are not meeting lenders’ minimum servicing requirements”.

Key Takeaways

- A softening market offers buying opportunities for tenants, first-time buyers, and investors.

- Investors see rental yield growth and use equity for borrowing, considering long-term cycles.

- First-time buyers re-enter cautiously, leveraging stamp duty changes and preparing properties for future rental.

- Challenges include increased mortgage repayments and stricter lending criteria.

- Leah Jay Investment Services provides pre-purchase analysis, investor network access, and financial partnership introductions.

How Leah Jay Investment Services help

- Provide independent advice on how to get started when looking to buy a property

- Investor Network* enabling investors looking to buy and sell their properties off market

- Pre-purchase analysis

- Guidance on suburbs, rents, yields, and types of properties

- Recommend various scenarios depending on your circumstances and objectives

- Initiation to our verified financial partners